As Cannabis Business Attorneys, we believe that the Michigan Marijuana Microbusiness license presents the best opportunities for local residents to enter the recreational cannabis market and survive the incoming wave of larger out of state marijuana companies. As we wait for Michigan’s Department of Licensing and Regulatory Affairs (LARA) to issue rules under the Michigan Regulation and Taxation of Marijuana Act (MRTMA), aspiring Michigan Microbusiness owners can start taking preliminary steps to set up their microbusinesses for long-term success.

There is not one “right” business plan or business model for marijuana microbusinesses. However, with several states, including California and Nevada having already enacted and implemented microbusiness legislation, we can look to microbusiness owners’ experience in these states to see what works and what doesn’t work.

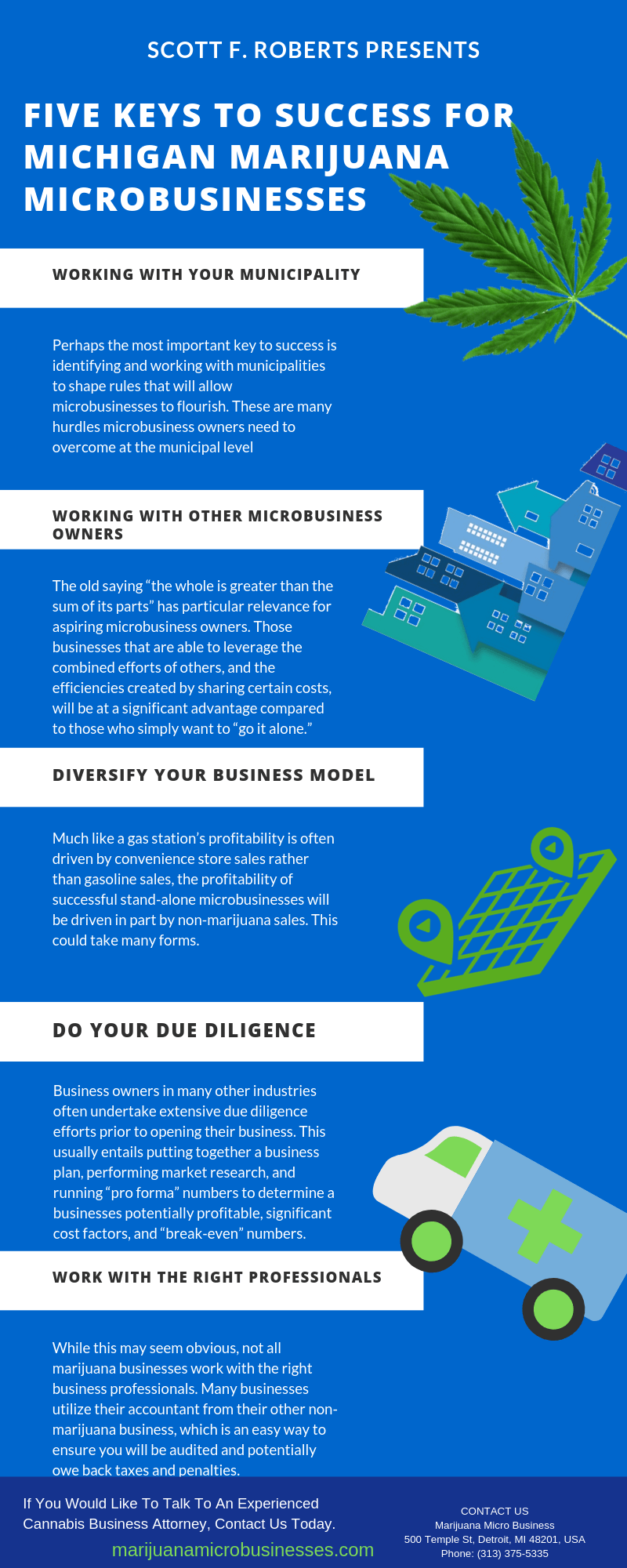

Having reviewed these out of state businesses, and drawing on our experience working with medical marijuana licensees, we have come up with five keys to success for microbusinesses that will inevitably apply to nearly all business models, from the Cannabis Lounge model , edible shop, or even ancillary business models like a marijuana arcade, yoga studio, or event space. The five “keys to success” listed below are intended to help guide aspiring Michigan microbusiness owners and put them in the best position to succeed.

Working with your Municipality

Perhaps the most important key to success is identifying and working with municipalities to shape rules that will allow microbusinesses to flourish. These are many hurdles microbusiness owners need to overcome at the municipal level, the most important of which is getting the cities and townships to simply allow microbusiness licensees in their municipalities in the first place.

The structure of the MRTMA heavily incentivizes municipalities to “opt-in” to microbusiness licenses. Similar to the MMFLA, under the MRTMA, 15% of the recreational marijuana excise tax goes to specific municipalities, while another 15% goes to counties. The “key” difference is that the MMFLA distributed the excise tax to these to municipalities based on the total number of MMFLA licenses in their boundaries, whereas the MRTMA will distribute the excise tax based on the number of dispensaries and microbusinesses in their municipality. This means that the more microbusinesses a city or township allows, the more tax dollars it will receive from the 10% recreational marijuana excise tax.

Since the 2008 housing crisis, when the taxable value of real estate across the state dropped precipitously, many municipalities in Michigan have been strapped for cash. When working with municipalities under the MMFLA, we have found the key selling point to cities and townships on the fence about “opting in” to the medical law was the anticipated revenue that would be provided by passing a Medical Marijuana ordinance. With the medical marijuana tax having just expired on March 6th, 2019, these municipalities will be on the hunt for additional revenue, and allowing microbusinesses may well be the perfect way to strengthen their balance sheets. These municipalities will get a lot more “bang for their buck” by allowing microbusinesses to proliferate and flourish compared to allowing retail dispensaries, but many are unaware of this incentive. It will be up to the microbusiness owners to educate municipalities on this subject.

While getting a municipality to opt-in is the first step, not all “opt-ins” will be created equal. Municipalities that place undue restrictions on microbusinesses—such as disallowing public use permits, or unduly restricting where sales will take place or where businesses can be located—will handicap microbusinesses, which will in turn limit the number of microbusinesses that will be viable in any given area.

Engaging your municipality and crafting rules favorable to your respective business model will, therefore, be key to your long-term success. Because municipalities generally do not make these sort of decisions quickly, now is the time for potential microbusiness owners to open up a dialogue with these municipalities to begin the process of opting into microbusiness license types and crafting ordinances that will allow their microbusinesses to flourish.

Working with Other Microbusiness Owners

The old saying “the whole is greater than the sum of its parts” has particular relevance for aspiring microbusiness owners. Those businesses that are able to leverage the combined efforts of others, and the efficiencies created by sharing certain costs, will be at a significant advantage compared to those who simply want to “go it alone.”

There are many ways that Michigan microbusiness licensees can work together towards a common goal. The first is lobbying municipalities to “opt-in” to the microbusiness license, as discussed above. A city council or board of trustees is way more likely to listen to multiple residents or business owners lobbying for microbusiness licensing in their municipality then one solitary resident or business owner. This strength in numbers will help combat against individuals who will be lobbying against their presence in a municipality, such as dispensary owners scared of the potential competition or your typical “marijuana is the devil’s lettuce” crowd.

Another way microbusiness owners can work together is to create “collectives” or other associations that allow them to share operating costs. With microbusinesses being limited to just 150 plants, it may not be financially practical to have two full-time cultivators on staff. Instead, it may be more efficient to have several part-time employees that are shared with other microbusinesses. For example, in larger medical cultivation operations, there is often one, highly experienced “master grower” making six figures, who oversees thousands or even tens of thousands of plants under cultivation. In this situation, it would make much more sense for microbusiness owners to come together and essentially share one highly experienced master grower among several licenses, as well as share the services of several cultivation assistants. This would allow microbusiness owners to hire better cultivation staff for less money.

This same concept can be applied to several other potential cost factors. A sub-divided building with several microbusinesses will likely have lower operating costs in terms of rent or real estate acquisition costs compared to microbusinesses in stand-alone buildings. The same could be said for customer acquisition costs. If several complimentary microbusinesses came together to sell at a common location—sort of like a farmer’s market for marijuana—they will be able to split their marketing and advertising costs with other microbusinesses. This also has the added benefit of making their location more of a “destination” to potential consumers. Similar to how bar’s often do better when there are several bars in an area, microbusinesses will likely do better when there are several microbusinesses in one location, with each one addressing a specific niche in the market.

Diversify your Business Model

This key to success is especially important to microbusinesses that don’t want to join a “cooperative” but instead want to function as a stand-alone business. Whether that’s a cannabis lounge, cannabis bakery or restaurant, or a more novel idea like a marijuana event space, spa, or yoga studio, not relying solely on marijuana sales as the only driver of revenue will be key to your long-term success. This is especially true given the current unfavorable tax treatment that marijuana retailers suffer under IRS Code Section 280E, which can be partially alleviated by non-Cannabis sales.

Much like a gas station’s profitability is often driven by convenience store sales rather than gasoline sales, the profitability of successful stand-alone microbusinesses will be driven in part by non-marijuana sales. This could take many forms.

Cannabis lounges—also colloquially known as coffee shops—can generate additional revenue from the sale of food and beverages. Marijuana bakeries can generate revenue from the sale of non-THC products like CBD edibles. More novel business concepts can make money from their ancillary businesses, whether that be events, yoga classes, and more. These ancillary sales will enable microbusiness owners to create additional revenue while also providing another service to their customers, which will in turn help drive more customers to your marijuana microbusiness.

Do your Due Diligence

Business owners in many other industries often undertake extensive due diligence efforts prior to opening their business. This usually entails putting together a business plan, performing market research, and running “pro forma” numbers to determine a businesses potentially profitable, significant cost factors, and “break-even” numbers.

It never ceases to amaze me how few Michigan medical marijuana businesses simply skip this step. In the rush to take part in the “green wave”, many cannabis businesses jump straight into the deep end of the pool without testing the waters first. Evaluating your business model and profitability ahead of time will enable your microbusiness to identify issues before they arise and prevent you from making costly missteps.

While pro forma numbers are important, it is also critical to conduct market research on your business model and location. This means microbusiness owners should evaluate locations based on factors such as pedestrian and automobile traffic, the number of residents living nearby, and the number of tourists that visit the area. This also means that you should conduct market research on whether there is actual market demand for your specific business model. For example, if you plan to start a “taste and tour” microbusiness similar to a winery, it is critical that there will be enough people in the area that actually want to take the tour. Knowing whether you will be relying more on seasonal visitors versus permanent residents will also affect how you run your business. In short, identifying these market factors early on will pay dividends down the road and prevent you from making costly mistakes.

Work with the Right Professionals

While this may seem obvious, not all marijuana businesses work with the right business professionals. Many businesses utilize their accountant from their other non-marijuana business, which is an easy way to ensure you will be audited and potentially owe back taxes and penalties. Similarly, working with a Cannabis business attorney with a background in business, as opposed to a Cannabis criminal attorney or a business attorney who lacks knowledge of the Cannabis industry, will help ensure your long-term success.

The same can be said for other professionals you made need to hire to help run your microbusiness. A cultivation expert with a decade of growing experience will likely be more knowledgeable than a caregiver who just got into the industry. Having said that, there are certain positions that may not require several years of industry experience.

A particularly bright marketer who is familiar with the cannabis industry but doesn’t have any cannabis industry experience may turn out better than a cannabis specific marketer who is already over-stretched. For example, a marketer with a strong track record of success working in the alcohol industry may be a better choice than a cannabis specific marketer with a less than stellar track record. Put simply, there is no one size fits all approach to hiring. However, that does not mean you shouldn’t be mindful of a potential employee or professionals experience, and more importantly, their track record working with other businesses.

Conclusion

The Michigan microbusiness license presents an enormous opportunity to caregivers and those unable to afford a costly MMFLA license to enter Michigan’s recreational marijuana market. We expect there to soon be hundreds of successful microbusinesses throughout the State of Michigan. Making sure your microbusiness is one of these successes will depend in part on your business model and your ability to execute on it. The five keys to success identified above, while certainly not exhaustive, are meant to provide Michigan microbusiness owners with a roadmap to success.

Our Marijuana Microbusiness Attorneys are ready to assist your Michigan microbusiness project. Our attorneys have practiced business, municipal and real estate law their entire careers. Unlike other “cannabis attorneys”, representing local businesses and start-ups is our specialty. We assist microbusiness clients in drafting business plans, running pro forma numbers, and working with individual municipalities to draft microbusiness ordinances. If you would like to talk to an experienced Cannabis business attorney, contact us today.